Embrace the Future with Our Digital Banking Ecosystem for Digital Banks and fintechs

Empower digital banks and fintechs with our Digital Banking Ecosystem, providing secure, easy-to-use solutions that simplify operations and improve customer experiences.

The Future of Digital Banking: SAAS Core Banking Platform in Constant Evolution

The world of finance is changing fast, and banks, credit unions, and fintechs need to keep up. Our digital banking solutions, banking SaaS core platform, make it easy to offer fast, real-time services and a great online experience helping you attract more customers and run your business smoother than ever.

Explore Our Cutting-Edge Core Banking Modules

With our modular architecture, banknbox gives access to its banking modules to help you to co-build your banking infrastructure:

Methods of Payments

Credit

Deposits / Savings Accounts

Banking Accounting

Regulatory Reporting

Analytics

Core Orchestrator

Card Management

Onboarding KYC/KYB

AML-CFT

Distribution

Internet banking nationwide and internationally

We deliver secure banking digital solutions with a simple internet banking login, giving you 24/7 access to your accounts anytime, anywhere. Based in Cairo, Amsterdam, Casablanca, London, Doha, Paris, Dubai, Manama, and Nepal, we combine global reach with local expertise to keep your banking easy and secure.

Audits

-

Customer access logs

-

Transaction logs

-

System configuration logs

-

Incidents assignment

-

User activities

Security

-

Strong authentication

-

Data encryption

-

Session management

-

Input validation

-

Access controls

Create Experience

-

New experiences suit

-

Single page web with high performance

-

A responsive architecture work for most of modern devices and browsers

Reusability

-

No additional APIs development

-

Consumption of mobile app services

-

Reuse CI/CD pipeline of Mobile app

Open Banking as a Service (OBaaS)

Delivering modern financial services starts with customer satisfaction. With Open Banking as a Service (OBaaS), banks and fintechs can provide faster, more personalized digital journeys. By leveraging secure APIs and advanced Open Banking infrastructure.

Improve Customer Experience

Expand Product Base

Capex Vs. Opex

Additional Revenues

Time to Market

Compliance & Security

Easy Payments with Mobile Phone Wallets & Mobile Wallets

Our Mobile Wallets and E-wallet services provide a seamless, efficient way to pay and manage money. With mobile phone wallets, customers can make transactions, track expenses, and handle finances anytime, anywhere. Enjoy fast, secure, and user-friendly mobile wallets and E-wallet solutions designed for modern digital life.

- Onboarding

- Contactless Payments

- Money Sharing

- P2P Payments

- Notification & Reminders

- Top-up

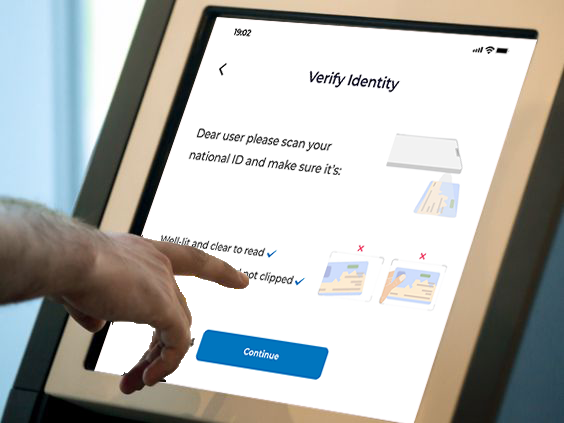

Banking Branch Tablet

Our banking branch tablet makes it easy for staff to help customers quickly. This digital branch tablet lets employees handle transactions, update accounts, and provide services smoothly, all from one simple device in the branch.

AI-Powerful Chatbot

Conversational Interface

Natural Language Processing

Personalized Response

Multiplatform Support

Transaction Processing

Instant Response

Automated Processing

IVR, Whatsapp, Mobile, Social Support

Get in Touch with Banknbox?

Ready to transform your banking services with our white label digital banking solutions?

Contact us today to learn more about our Banking Solutions, card issuing solutions, and SaaS banking services.